Banks Need A 'Permanent Change In Mindset' : Remove The Link Between Sales Targets And Compensation, Says G30

The “slow, uphill battle to re-establish trust” in the financial services industry continues a decade after the global financial crisis, says a report from the Group of Thirty (G30), a consultative group on international economic and monetary affairs and an independent non-profit body. As one of its recommendations on what is needed to bring about real change, it suggests going to the heart of thinking on banker’s pay, and removing the link between sales targets and compensation.

Banking Conduct and Culture: A Permanent Mindset Change, published today by the G30 working group on banking conduct and culture, considers progress made in the three years since its last report, and stresses the need to focus on leadership at every level of an organisation.

“Incentives matter and out-sized incentives can have problematic outcomes, be it in the context of sales targets or even tax avoidance and money laundering. This is why we recommend removing the link between sales targets and compensation” said Gerd Haeusler, former chairman and CEO of Bayerische Landesbank and currently senior adviser goetzpartners, who is on the G£0 steering committee.

There is no shortage in the news this week of reports on investigations into money laundering involving European banks. Nor is there a shortage of investigations around allegations of tax evasion.

“Culture and conduct issues are not restricted to certain regions or types of business such as investment banking. A permanent mindset change will be required among European banks as well in order to fully restore trust within the public sector at large” said Mr Haeusler.

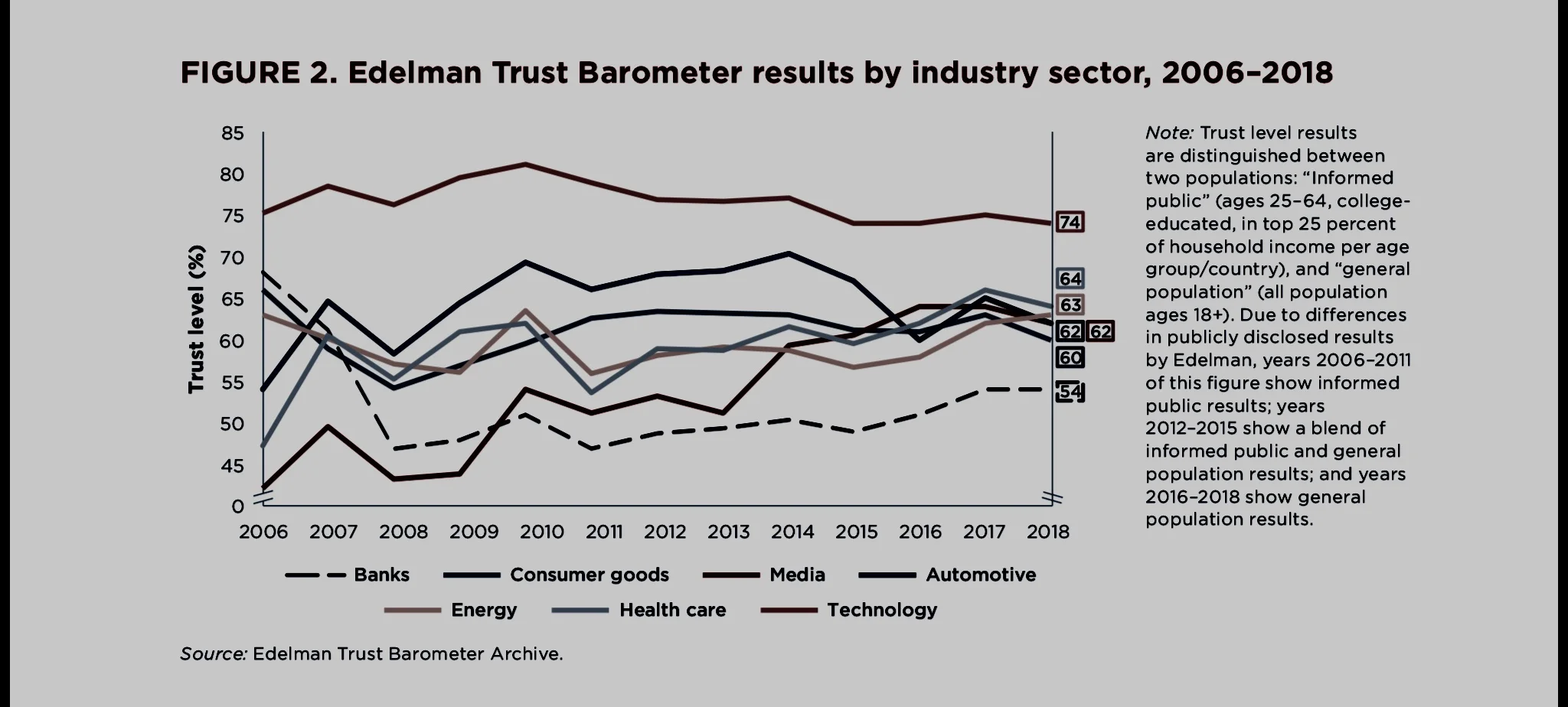

The Edelman Trust Barometer speaks volumes on the state of the Financial Services industry, which historically - at the end of World War Two - ranked among the most highly trusted. Today it languishes well below other sectors such as Consumer Goods, Healthcare or Automotive and at 54, is a whole 20 points below Technology in 2018.

Source: Banking Conduct and Culture: A Permanent Mindset Change, p3 via Group of Thirty, Washington, DC, USA November 29, 2018, reproduced by kind permission of G30.

For a United Kingdom poised on the edge of an ‘unknown unknown’ sometimes called Brexit, the figures are something of a double whammy.

Writing here the other day on the asset management industry, that same trust barometer made an appearance when I quoted Alex Chisholm, Permanent Secretary at the UK Department for Business, Energy and Industrial Strategy (BEIS). He said in a recent speech in London: “according to Edelman’s latest Global Trust Barometer, trust in UK business declined from 45% to 43% last year, putting us even further below the current global average of 52%.”

The G30’s report points firmly to the need to focus hard on middle management in order to bring about change.

“Middle management in particular plays an integral role in embedding cultural reforms. Leading by example and ensuring that day-to-day activities in the front line are consistently aligned with company values is critical” said Gail Kelly, former CEO, Westpac Banking Corporation and now senior global adviser, UBS AG, who is on the G30 Steering Committee.

Those who have worked hard to improve diversity in the UK financial services industry over the last decade will find this a compelling argument. Having followed that drive closely, I submit that the reluctance of (mainly male) middle managers to countenance the progression and promotion of promising women - often in favour of mediocre men - has a lot to do with the wall of resistance that appears to exist around better gender diversity.

But such diversity is critical to both cognitive diversity, and by extension to dynamic input on ethical concerns, into any industry sector. Financial services, I would argue, is particularly in need of gender balance as endless studies have shown us that attitudes to risk vary across the gender divide.

The reality is a one-sided snapshot of an industry that affects 100% of the consumer population, with women making up a critical 50%. We certainly know from the latest from the UK government-backed Hampton-Alexander Review, also covered on Board Talk, that the country is struggling with this issue.

Reproduced by kind permission of G30, Washington DC USA November 29, 2018

This G30 report makes many recommendations on action needed, including valuable guidance on how changing board structure can enable the success of cultural and conduct reforms. Britain’s boardrooms are, of course, deeply resistant to any such change and in that they are pandered to and and supported by a plethora of consultancies and advisory services for whom it does not pay to rock the boat. It is easier to spend years hosting events around “culture” which conclude that it is a “nebulous” concept, difficult to identify.

But they might sit up and take notice here, for innovation is needed and here is some. The Vice-Chair of the G30 Steering Committee is none other than Sir David Walker, former chairman Barclays, and chairman, Winton.

‘There is significant risk of dilution and dispersion of responsibility for the governance of something as broad as culture. We recommend the creation of a dedicated board committee to ensure continuing focused attention and accountability on culture” said Sir David.

“We have also concluded, that, while difficult, conduct and behaviour, the building blocks of a firm’s culture, can be measured and monitored. Appropriately regular audit of conduct and behaviour offers a sure pathway to effective and permanent embedding of the bank’s culture” he added.

Think data, think intelligent use of technology to measure, analyse, change operational structure as needed. This report is invaluable for banks drowning in the “conduct culture fatigue” it identifies. Because, as it suggests, regulation has a limited role to play when it comes to culture and conduct but changing both is essential amid the disruption of challengers, if banks are to survive and prosper.

In Britain over the last few years we had a welcome development - the establishment of a Banking Standards Board in 2014. At the time it seemed exciting, and a step away from the temptation to define anything that is difficult to undertake as somehow too “nebulous” to attempt it. But this is the last UK media coverage I remember seeing on its progress. (November 2018).

This report is very welcome, and overdue for banks to take seriously.

Finally, I have written on Board talk about the critical need for collaboration around cyber-security for better corporate governance. The financial services industry might perhaps be living in a past where it believes that competitive intelligence is the way to making big bucks, never mind the collaboration. But the world has changed very fast, in some ways.

So I am delighted to see this statement in the G30 report:

“Trust is an industry common good rather than institution-specific competitive advantage.” and as I am out of time, here’s the text in more detail.

Screen shot (with kind permission of G30) Banking Conduct and Culture: A Permanent Mindset Change November 29, 2018 Group of Thirty, Washington, DC. USA

Main image credit: ‘Taller than trees’ : Sean Pollock on Unsplash