Global Alert: No Visibility Beyond Tier 1 Suppliers In Procurement

The collapse of the UK's second largest construction firm - Carillion plc- has the country all of a dither on multiple fronts. As a big supplier to the public sector, the ramifications of its collapse are immense. Parliamentary hearings into Carillion have also yielded quotes about the role of audit that are destined to go down in history, notably Peter Kyle, MP to KPMG: "I would not trust you to audit the contents of my fridge."

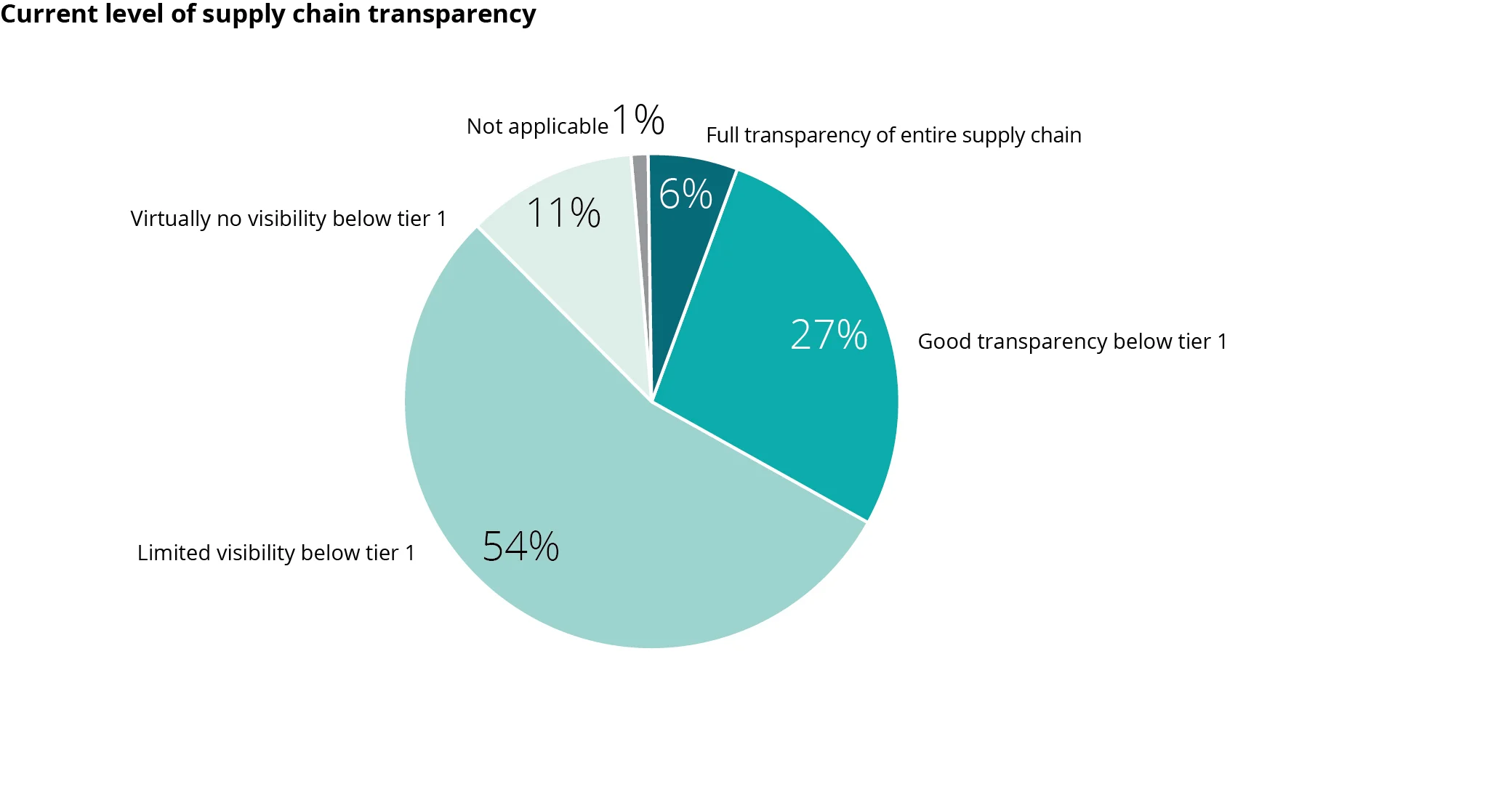

An annual report just out should be of great concern not only to UK plc, but to all listed businesses. A global survey of 500 procurement leaders reveals that 65% of them have "limited or no visibility beyond their tier one suppliers."

The Deloitte Global Chief Procurement Officer (CPO) Survey 2018 covers 39 countries and organisations with a combined annual turnover of $5.5 trillion (£3.95 trillion).

While visibility of the supply chain is crucial for businesses to ensure factors such as meeting regulatory requirement and risk planning, currently just 6% of procurement leaders say they have full transparency of their entire supply chain. It makes a nonsense of the notion of managing risk, which is said to be a priority for 54% of procurement leaders taking part in the survey.

“Two in three procurement leaders have limited visibility beyond their tier one suppliers. This has major implications for organisations across all industries, particularly for meeting regulatory and corporate social responsibility requirements and for the identification and mitigation of supply chain risks" says Brian Umbenhauer, principal and global head of sourcing and procurement at Deloitte.

Transparency below Tier 1 : Deloitte Chief Procurement Officer Survey 2018

Improved transparency of pricing, supplier locations and critical dependencies can help procurement leaders deliver greater value, he adds, and also avoid potentially significant regulatory, reputational and operational risk.

The Deloitte report around the survey finds that CPOs are most likely to cite the uncertainty and outcomes of trade negotiations, such as Brexit and NAFTA, as a significant risk factor (33%). "The slight improvement in economic sentiment has not altered the overall willingness of businesses to take on additional risk..... UK growth has conspicuously slowed, particularly in comparison to many other countries that are enjoying the global upturn" it says.

Back in 2016, I covered the same survey on Forbes, noting the citing of a shortage of necessary skills by CPOs on the teams mandated to deliver procurement strategy. It appears to have improved, but marginally. Some 62% of CPOs in 2016 cited a shortage of skills needed for successful delivery of strategy, and 51% of them feel that way today.

But it's hard to see why, when 72% of procurement leaders spend less than 2% of their operating budgets on training and development for their teams (compared to 66% last year). Cost-cutting is a strong focus, and there appears to be limited appetite to develop digital skills within their teams. "The level and speed of digitalisation across procurement functions is lower than expected and needed" says Deloitte.

Over four years of writing on corporate governance and leadership for Forbes between 2013 and 2017, I kept coming back to supply chains. In 2015 I declared: "procurement has been steadily claiming a voice in the boardroom." Even assuming I was right, has it got anywhere - and does it matter today ?

I think it does, because these are the nitty-gritty issues that matter, and that intertwine to dictate the strategic direction of any business, the corporate governance behind it, and the culture that takes it forward.

How can it possibly be that 65% of global procurement leaders surveyed by Deloitte have "limited or no visibility beyond their tier one suppliers" ? And without such knowledge, what hope is there for all the codes of corporate governance in the world.

It's a rhetorical question. But in a world of big data, the answer seems to be an acute lack of innovation everywhere - it's a global survey.

The UK's Institute of Business Ethics is just launching a Board Briefing on culture that appears to agree with this line of thinking. It conducted a survey that suggests that boards appear to pay relatively little attention to some issues that might provide important insights on culture.

It identifies them as including include customer complaints and supply chain data (including payment terms and grievances). Two fifths of boards it surveyed do not receive information on customer satisfaction, says the IBE, while only 20% receive data on the supply chain relationship.

We need to redefine where ultimate power lies in the operations of a listed business responsible to multiple stakeholders - and to society - and then ensure it has the right lines of communication to it.